‘Carbon insetting: Move up the carbon investment ladder!’ was recorded live as part of thinkstep-anz’s ‘Straight from the Horse’s Mouth’ webinar series.

A follow-up to thinkstep-anz’s offsetting webinar with Ekos, this webinar introduces the lesser-known option for carbon management that offers a secure supply of carbon credits for the future.

We invited Sean Weaver, CEO at Ekos, and Mark Harris, Renewable Development Programme Manager at Meridian Energy Limited to explore the ins and outs of carbon insetting.

Offsets and insets

There are two main paths to acquiring carbon credits for zero carbon certifications for an organisation: offsetting and insetting. Both come after measurement, and after reduction or concurrent with reductions. These starting steps of the carbon journey remain the same whether you choose to offset or inset. Once measurement, reduction planning and verification have been considered, the path diverges into two. Offsets cause carbon benefits outside of the business boundary, whereas insets expand the business boundary to cause carbon benefits within an organisation’s business boundary or supply chain. Therefore, the combination of reduction with either offsetting or insetting can set your organisation on similar paths to zero carbon.

Read more about the carbon journey and the process of offsetting here or check out our webinar with Ekos here.

The ins and outs of insets

When you cannot reduce your footprint any further or it stops being a viable option, you have the choice to inset or offset. Offsetting and insetting share more than a few common processes; both options produce certified carbon credits that are issued in a registry and need to be cancelled when used to avoid double-counting. Insetting also follows the strict quality controls associated with offsetting, with verification for certified carbon credits available with NZUs sourced from the compliance carbon market and/or, VERs or VCUs being sourced from the voluntary carbon market.

The main difference between the two is that insets allow an organisation to create their own supply chain of credits rather than buying them on the market as would be the case with offsets.

Secure your future carbon supply

Insetting has a wide range of benefits to offer in the long-term, especially for bigger organisations. Growing your own carbon credits has a higher cost in the short-term and lower costs in the long-term. With the Paris Agreement obligations to be met by 2030, increasing demand for carbon credits and a potential international scarcity as a result, the prices are more than likely to increase. However, organisations with their own insetting projects will be able to acquire credits at cost, rather than becoming exposed to future prices in the carbon market. If your organisation’s reliance on carbon credits is expected to rise in the future, insetting will ensure both a secure supply of carbon credits and shelter from future fluctuations in price that are likely to occur on the open market.

Creating your own carbon forest

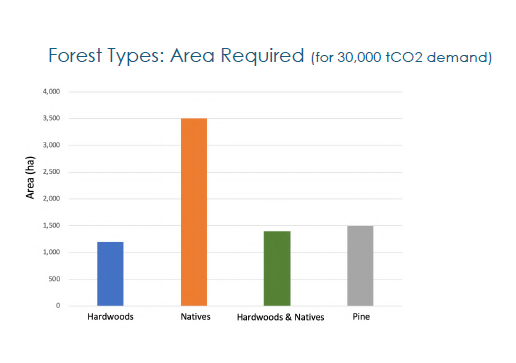

While there are a variety of options for carbon credit generation, carbon credits in New Zealand come from forest projects. Forest types within the New Zealand insetting landscape include exotic softwoods (e.g. pines), exotic hardwoods (leafy trees), natives, and mixed exotic and native combinations. The expected costs associated with an insetting forest project are influenced in part by the size and type of project needed, which in turn is influenced by an organisation’s goals and requirements. Carbon insetting experts can provide guidance during the initial stage to create a project best suited to your goals.

Meridian Energy Limited had three key goals in mind for their insetting project: positive commercial outcome, positive native biodiversity outcome and long-term community and stakeholder engagement. Ekos presented Meridian with the costs and benefits of different options and Meridian elected an approach prioritising native-only reforestation where possible, and mixed exotic hardwoods and natives when not possible, and the Meridian Forever Forests Project began.

Meridian Energy Limited made the decision to inset locally instead of continuing to buy offsets in the international carbon credit market as is common. The decision was influenced by a desire to help decarbonise the economy, meet aspirations for 100 percent renewable energy by 2035, and for its economic viability in the future. In order to meet their goal for a positive biodiversity outcome, the company is taking care to plant the right trees for the ecology of different sites within their project.

Although the electricity provider will not be able to cover all credits locally due to the variable nature of the electricity grid in New Zealand, it will be able to inset 37,000 tonnes per annum. The ongoing project will see the company plant at least 1.5 million to 2 million trees for this purpose, equating to a minimum of 1500 hectares (approximately 3000 rugby pitches).

Read more about the project here.

A flexible and future-proof solution

Both offsetting and insetting have an important role to play in carbon management based on an organisation’s goals and scope. Insetting will stand out to organisations that require flexibility in choosing the right project for them or need an economically viable and stable supply of carbon credits for the future. Unsure whether insetting is the right option for you? Read more about insetting here and find out whether there is a carbon forest waiting in your future.

Moving forward

thinkstep-anz offers specialised services to start your carbon journey. Find out more about our carbon footprinting services, or contact us to start a conversation.

All images courtesy of Ekos.

Ekos is an offsetting expert that focuses on supply of high-quality forest carbon credits, zero carbon certification and carbon footprint measurement and reduction plans.

Meridian Energy Limited is an NZX and ASX listed utility company that is New Zealand’s largest provider of renewable energy.