Financing a nature-positive future – the role of the insurance sector

In this blog, we report from the London Climate Action Week

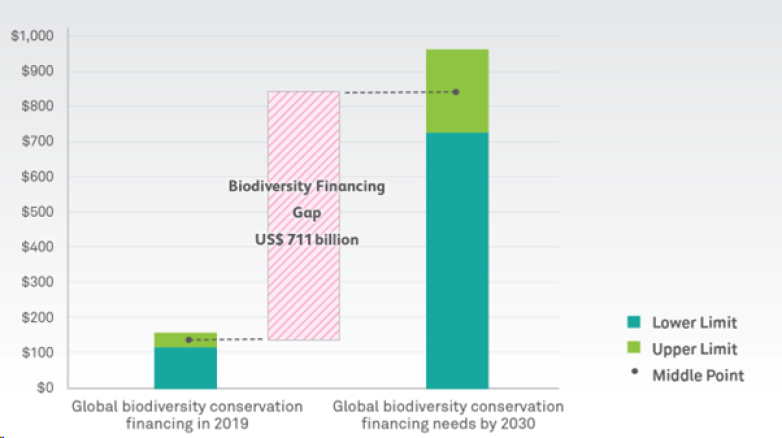

Our Nature-related Disclosures team has been digging into the nature-related risks and opportunities in Australia and New Zealand. We have highlighted the critical economic role of nature in our recent blogs and webinars. However, a significant nature finance gap persists—the shortfall between necessary funds for nature protection and actual investment. The insurance sector can play a critical role in filling this gap, because it is not just a form of governance – it is an option on capital too. Globally, this might be a $10 trillion option.

Source: Paulson Institute

During London Climate Action Week, the Insurance Group Howden hosted a summit to explore insurance's role in the transition to a net-zero, nature-positive future. The insurance sector could play a huge role in this future in three steps:

- Facing the facts

- Time to act

- Building the bigger picture

Here’s how:

Really seeing climate change

The insurance sector is experienced in preventing capital losses and putting a price tag on risk. However, this does not yet fully extend to climate risks and nature risks. Risk managers are increasingly seeking quantitative data for this. As the sector starts finding this additional data, more risks become visible – and more stranded assets can be seen on the horizon. This in turn creates a need for insurance products that adequately cover climate risk.

Being proactive

New insurance products will transfer climate risks off the shoulders of individuals and businesses and into the insurance market. However, this must be done in a way that also slows down the rise in insurance premiums, which are currently set to grow by 50% by 2030, representing a major capital constraint for the insurance sector. This is a key reason for the insurance sector to help the private sector and wider markets to understand their true exposure to climate- and nature-related risks. Proactivity beats reactivity.

Sharing data to understand risks

Climate risk and loss prevention experts could share data to help the insurance sector to fully see and understand their potential exposure to climate change. This in turn could help their customers - individuals, businesses and financial institutions - to fully understand their nature- and climate-related risks and opportunities, so they might adapt, mitigate and respond.

Facilitating innovation and de-risking the transition

According to Howden’s white paper The bigger picture, $19 trillion has already been invested to finance the climate transition up to 2030. But this needs insurance to fly. Emergent innovations can struggle to obtain finance because of the risks associated with:

- The new technology succeeding

- The project keeping to budget and schedule

- The project failing to deliver

These risks often exceed the risk tolerance of investors; they’re too big for venture capital, and too unstable for the private sector – but the insurance sector can handle it. Insurance has the potential to work with businesses to secure the capital needed to commercialise low-carbon and/or nature-positive innovations. To realise this, insurance must play a strategic role in how risk is allocated to contracts and captured in finance.

However, whilst mitigation and adaptation is the bulk of the climate transition, it won’t cover everything.

Building biodiversity and carbon markets for those ‘residual emissions’

Carbon markets have recently faced scrutiny and criticism, but they may well be necessary for some organisations to eventually achieve ‘net-zero.’ Globally, it’s accepted we won’t be able to decarbonise 100% of GHG emissions – the leftovers (residual emissions) must be removed. This creates a need for offsets, credit markets, carbon removals projects and nature-based solutions.

To quell concerns about the integrity of these markets, the insurance sector could act to regulate these markets to ensure they are equitable and effective. This will require collaboration with indigenous communities. It will also require partnerships to be fostered between the private sector and insurance sector to grow investments in carbon removals projects, and nature-based solutions.

A helping hand from government

Current regulations have been written in a high-carbon world, and it’s a slow process for insurers to release new insurance products – like the climate risk projects businesses and individuals need. It may help for regulations to be reviewed and adapted to support the innovations insurers may start striving for.

Governments should also lead by example in climate risk preparedness and ensure they do not simply act as a last resort if disaster strikes. They can do this by incorporating climate and nature risks into national balance sheets, and into financial planning.

Unlocking significant investments for the climate transition

It's true what they say – without insurance, planes don’t fly, and a positive climate transition might not happen. The insurance sector holds the potential to unlock significant investments for the climate transition. By supporting innovations to take off, collaborating with governments to build resilience, and adopting a long-term perspective to meet private sector needs, insurers can help close the nature finance gap and drive the transition to a net-zero world.